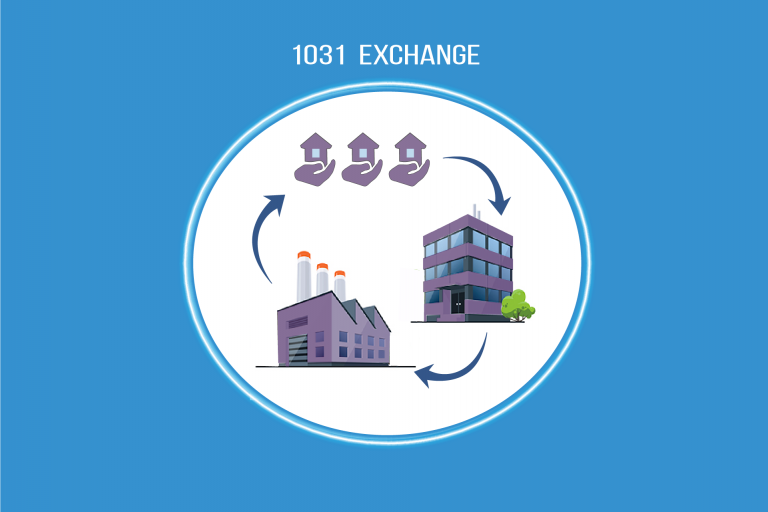

A 1031 Exchange is really a transaction that allows a trader to defer investment capital results taxes about the sale of the expenditure residence by reinvesting the profits from your transaction right into a very similar home. The 1031 Exchange receives its name from IRS Section 1031, which lays out of the regulations for these kinds of purchases.

To accomplish a 1031 Exchange Timelines and Rules, many crucial techniques has to be implemented. Initially, your property that is being offered must be properly recognized. The tax payer has 45 days through the date of the selling to distinguish as much as three possible replacing properties. The tax payer must then acquire among those qualities within 180 times of the transaction of the authentic residence.

If done correctly, a 1031 Exchange can be a potent tool for brokers planning to defer funds gains income taxes and boost their portfolios. Nonetheless, it’s worth noting that many regulations and rules needs to be followed for your exchange to get reasonable.

1031 Exchange Regulations

To finish a 1031 Exchange, numerous crucial steps has to be put into practice. First, the house which is being offered needs to be properly discovered. The tax payer has 45 times from your particular date from the purchase to identify approximately three potential replacement attributes. The tax payer must then acquire one of those qualities within 180 times of the transaction of the original residence.

If done efficiently, a 1031 Exchange can be quite a highly effective instrument for investors trying to defer investment capital gains income taxes and grow their portfolios. However, it’s important to note that numerous regulations and rules has to be followed for that exchange to get valid.

Many of the most essential policies consist of:

The exchanged properties must be “like-kind.” Which means that they must be investment or organization-use attributes held for effective use within buy and sell or company or for expense purposes. Personalized-use property such as your primary house will not qualify.

Both qualities should be found in the usa

You can not receive any money or other sort of “boot” in your exchange. All profits in the selling of the original residence must be used to buy your substitute residence

They are just a few of the countless regulations that pertain to 1031 Exchanges. To learn more about the way to complete a 1031 Exchange, please speak to our workplace nowadays.

Conclusion:

A 1031 Exchange might be a terrific way to defer funds gains taxes and increase your expenditure portfolio. Even so, it’s important to note that a number of regulations and rules pertain to these types of dealings. Be sure you talk to a competent taxes professional before completing a 1031 Exchange to ensure that you adhere to all relevant legal guidelines.